How Can We Help?

Book Now, Pay Later

Book now, pay later without the fees

It is the smartest way to pay over time. Book your dream holiday now and pay at your own pace without any fees, so you can get the things you love without breaking your budget.

At checkout step 3, you can choose to Book Now and Pay Later” option .We will send you a payment link from Stripe with provider options, or you can request from us.

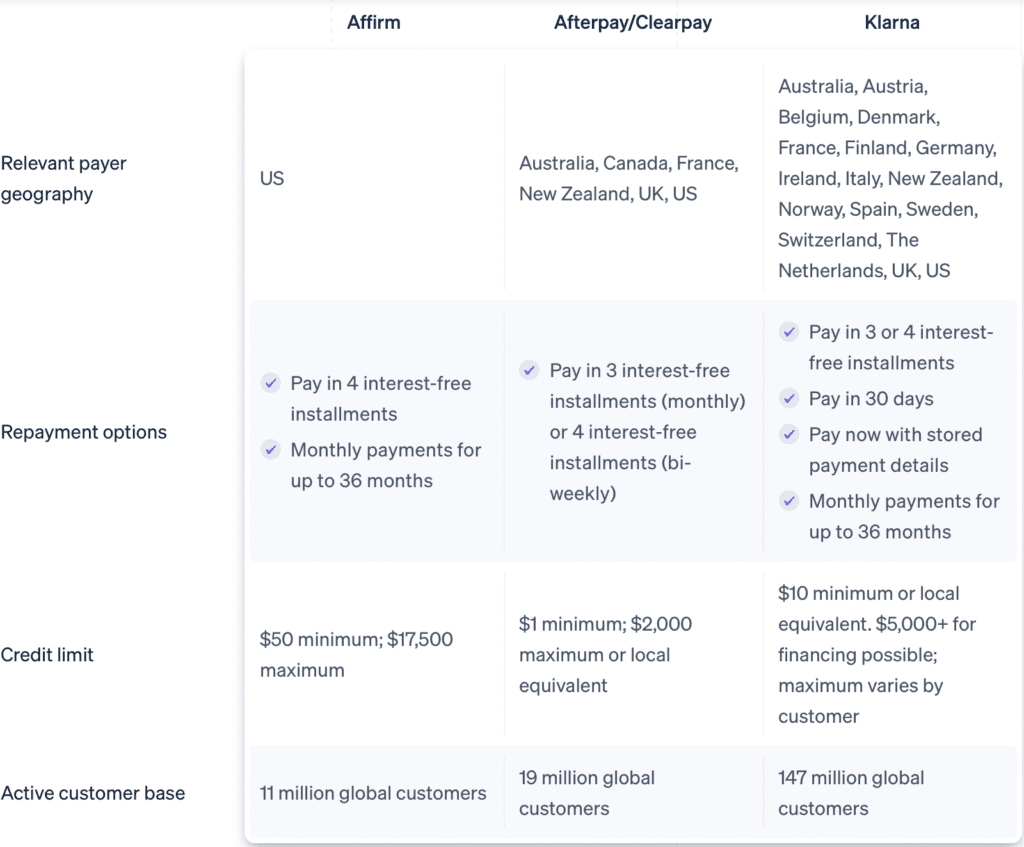

Our Global “Buy Now Pay Later” Partners

Pick the payment option that works for you and your budget—from 4 interest-free payments every 2 weeks to monthly installments.

Providers

Affirm

Affirm has a network of more than 11 million shoppers in the US. Customers can choose from one of two options for payment:

- Affirm Split Pay allows customers to make an online purchase and spread the cost over four interest-free installments.

- Affirm Installments offers customers up to 36 months of credit. To receive financing, they complete a one-time application. If approved, customers make their monthly payments to Affirm online or in the mobile app.

Affirm abstracts away the complexities of identifying which payment options and terms to offer to your customers by using a number of inputs to present the options that are most likely to result in the highest conversion on your behalf, at no additional cost. Unlike other buy now, pay later providers, Affirm does not charge any late fees.

Klarna

Klarna offers the most variety in payment options, which gives customers more freedom to choose when and how to pay for a purchase. Klarna provides payment solutions for 140 million consumers and more than 250,000 businesses across 17 markets.

There are four different ways for customers to pay for a transaction with Klarna: Pay in Installments, Pay Later, Pay Now, and Financing:

- Klarna Pay in Installments allows customers to make an online purchase and spread the cost over three or four interest-free payments*.

- Klarna Pay Later in 14 or 30 days lets customers immediately complete a transaction and pay the full amount later, at no additional cost.

- Pay Now is offered in many European countries and lets a customer pay for a transaction immediately using stored payment credentials. Supported payment methods include bank transfers or direct debit.

- Klarna Financing offers customers up to 36 months of credit. To receive financing, they complete a one-time application. If approved, customers make their monthly payments to Klarna online or in the mobile app.

Any charge?

- Fees – They don’t charge any fees. That means no late fees, no prepayment fees, no annual fees, and no fees to open or close your account.

- Interest – Depending on the size of your purchase and where you’re shopping, your payment plan may include interest. You’ll never owe more interest than you agree to on day one—so you always know exactly what you’re getting into.